The world of finance can seem daunting, but buying bonds online is a straightforward process that offers a great way to diversify your investment portfolio. Bonds are essentially loans you make to a company or government, and in return, they pay you interest over a set period. Think of it as being a bank for a big entity. This article will guide you through the process of buying bonds online, explaining the different types of bonds and the key factors to consider before you invest.

Understanding the Basics: What are Bonds?

Before we dive into the “how,” let’s quickly cover the “what.” A bond is a debt security. When you buy a bond, you’re loaning money to the issuer (e.g., a corporation or government). In return, the issuer promises to pay you back the principal (the original amount you invested) on a specific maturity date. They also typically make periodic interest payments, known as coupon payments, throughout the life of the bond.

There are a few key terms you’ll hear when talking about bonds:

Principal (or Face Value): The amount the issuer agrees to repay at maturity. Most corporate bonds have a face value of $1,000.

Why Invest in Bonds?

You might be asking, “Why would I want to buy bonds when stocks can offer higher returns?” Bonds play a different role in an investment portfolio. They are generally considered less risky than stocks and can provide a steady income stream. They’re often used to balance out a portfolio’s risk profile, acting as a buffer against stock market volatility. For many, especially those nearing retirement, bonds are a key component of their investment strategy.

The Step-by-Step Guide to Buying Bonds Online

Buying bonds online is easier than ever, thanks to online brokerage platforms. Here’s a general roadmap of the steps you’ll take:

Step 1: Open an Online Brokerage Account

The first and most crucial step is to open an account with a reputable online brokerage firm. Popular choices include Fidelity, Charles Schwab, ETRADE, and Vanguard. These platforms offer a wide range of investment options, including bonds. When choosing a brokerage, consider factors like:

Fees and Commissions: Some brokers charge a commission for each bond trade. Look for platforms with competitive pricing.

Once you’ve chosen a brokerage, the process of opening an account is similar to opening a bank account. You’ll need to provide personal information, such as your social security number and address, and link a bank account to fund your new investment account.

Step 2: Fund Your Account

After your account is set up, you need to transfer money into it. This is typically done through an electronic funds transfer (EFT) from your linked bank account. The process is usually quick and straightforward, and most brokerage platforms will walk you through it.

Step 3: Research and Choose Your Bonds

This is where the real work begins. There are several types of bonds, and each has its own risk and return profile. You need to decide which ones are right for you.

Corporate Bonds: Issued by companies to raise capital. These can offer higher yields than government bonds but also come with a higher risk of default.

When researching bonds, pay attention to the following:

Credit Rating: Agencies like Moody’s and Standard & Poor’s (S&P) assign credit ratings to bonds. A high rating (e.g., AAA or AA) indicates a low risk of default, while a lower rating (e.g., B or C) suggests a higher risk.

Most online brokerages will have a dedicated section for bond trading. You can use their search filters to find bonds that match your criteria, such as maturity date, coupon rate, and credit rating.

Step 4: Place Your Order

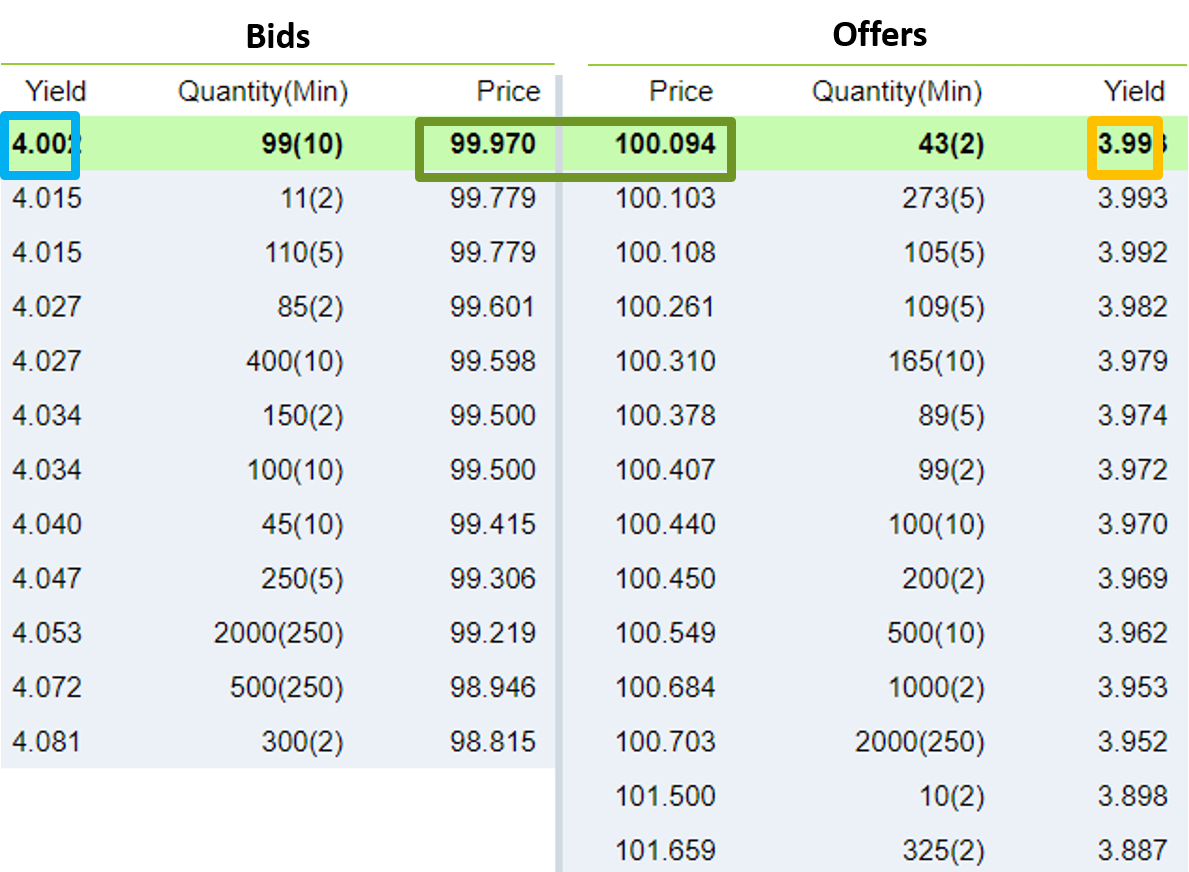

Once you’ve found a bond you want to buy, you’ll place an order. This is similar to buying a stock. You’ll specify the bond’s symbol or CUSIP number (a unique identifier), the number of bonds you want to buy, and the price you’re willing to pay.

There are two main ways to buy bonds:

New Issue Market: You buy bonds directly from the issuer when they are first offered to the public.

When you place your order, you’ll see the current market price of the bond. Bonds can trade at a premium (above face value) or a discount (below face value), depending on current interest rates and the bond’s coupon rate.

Step 5: Monitor Your Investment

After you’ve bought your bonds, it’s not a “set it and forget it” situation, but it’s close. You’ll receive your regular interest payments (typically every six months) and the principal when the bond matures. You should still monitor your portfolio and keep an eye on market conditions, but bonds are generally a more passive investment than stocks.

Important Considerations Before You Buy

While buying bonds online is straightforward, there are some important factors to understand to protect your investments.

Interest Rate Risk

This is one of the biggest risks in bond investing. If interest rates rise after you buy a bond, the value of your existing bond will likely decrease. This is because new bonds being issued will offer a higher coupon rate, making your lower-coupon bond less attractive to other investors. Conversely, if interest rates fall, the value of your bond will likely increase.

Inflation Risk

Inflation erodes the purchasing power of your money. If the rate of inflation is higher than the interest rate you’re earning on your bond, you’re losing money in real terms. This is why many investors diversify into other assets, like stocks, which have historically done better at keeping up with inflation.

Default Risk

This is the risk that the bond issuer will be unable to make its interest payments or repay the principal. This risk is very low for bonds issued by stable governments but can be a significant concern for corporate bonds, especially those with lower credit ratings. This is why credit ratings are so important. A bond with a low credit rating is often called a “junk bond” or a “high-yield bond” because it offers a higher return to compensate for the higher risk of default.

Advanced Strategies and Alternatives

As you get more comfortable with buying bonds, you might want to explore some more advanced options.

Bond Mutual Funds and ETFs

Instead of buying individual bonds, you can invest in a bond mutual fund or an Exchange-Traded Fund (ETF). These are professionally managed funds that hold a large portfolio of different bonds. They offer instant diversification and are often easier for beginners to manage. ETFs are especially popular because they trade on an exchange just like stocks, so they are very easy to buy and sell.

Bond Ladders

A bond ladder is a strategy where you invest in multiple bonds with staggered maturity dates. For example, you might buy a bond that matures in one year, another in two years, and another in three years. As each bond matures, you can use the proceeds to buy a new long-term bond, effectively “climbing the ladder.” This strategy helps manage interest rate risk because you’re constantly reinvesting at new rates, and it provides a steady stream of income as bonds mature.

Conclusion

Buying bonds online is a fantastic way to add stability and a predictable income stream to your investment portfolio. By understanding the basics of what bonds are, how to use an online brokerage, and the key risks involved, you can confidently navigate the bond market. Start with a solid plan, choose a reliable brokerage, and always do your homework before you invest. Bonds may not be as exciting as stocks, but they are a foundational part of a well-balanced financial strategy, and learning to buy them online is a skill that will serve you well for years to come.