Title: High-Yield Savings Accounts vs. CDs: Your Guide to Smarter Saving

Introduction: The Money-Making Showdown

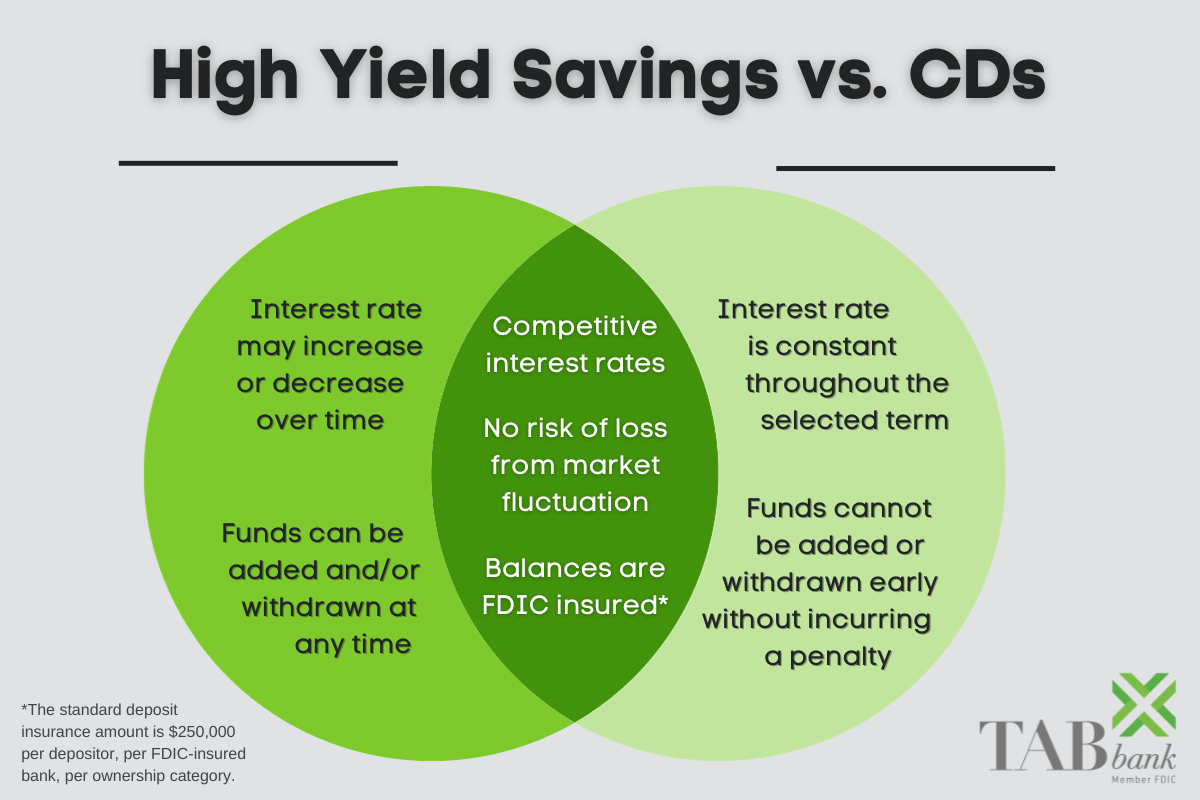

Ever feel like your money is just sitting there in a regular old savings account, collecting dust? You’re not alone. In today’s financial world, where every dollar counts, a traditional savings account’s measly interest rate just doesn’t cut it. You’ve probably heard a lot of buzz about “high-yield” savings accounts and “CDs,” but what’s the real difference? Which one is the right choice for you?

This isn’t about complicated financial jargon or boring spreadsheets. This is about understanding your options in plain, simple English. We’ll break down the pros and cons of high-yield savings accounts and Certificates of Deposit (CDs) so you can make a smart decision and get your money working harder for you. By the time you’re done reading this, you’ll be able to confidently decide where to put your hard-earned cash, whether it’s for a short-term goal or a long-term dream.

Let’s dive into the details and find out which of these two popular savings vehicles is the true champion for your financial goals.

What Exactly is a High-Yield Savings Account?

Think of a high-yield savings account (HYSA) as the super-powered version of your regular savings account. It’s a place to stash your cash, just like your old account, but it pays you a significantly higher interest rate. We’re talking about rates that can be ten or even twenty times higher than the national average. This is usually because these accounts are offered by online banks, which have lower overhead costs than brick-and-mortar institutions. They pass those savings on to you in the form of a better Annual Percentage Yield (APY).

The best part about a HYSA is its flexibility. You can deposit money whenever you want, and you can withdraw it when you need it. There are typically no penalties for taking your money out. This makes it an ideal place for your emergency fund, which needs to be accessible in a pinch. It’s also great for saving up for a specific short-term goal, like a down payment on a car, a big vacation, or a home renovation. The interest you earn helps you reach your goal faster, without you having to do anything extra.

However, there’s a catch. The interest rate on a HYSA is variable. That means it can change over time, moving up or down based on what’s happening with the broader economy and the interest rates set by the Federal Reserve. When interest rates are rising, this is great news because your money will earn more. But when rates start to fall, your HYSA rate will likely follow suit. This is a key difference to keep in mind—the return isn’t guaranteed for the long run.

Most HYSAs are also FDIC-insured, so your money is safe up to the legal limit of $250,000 per depositor, per bank. This is a huge peace of mind, knowing that even if the bank were to fail, your savings would be protected. Many HYSAs also have no monthly fees and don’t require a minimum balance, which makes them easy and affordable to use.

Let’s summarize the key points of a High-Yield Savings Account:

– What it is: A savings account with a much higher interest rate than a traditional account.

– Flexibility: You can add or withdraw money at any time without penalty.

– Interest Rate: Variable. It can change based on market conditions.

– Ideal for: Emergency funds, short-term savings goals.

– Safety: FDIC-insured up to $250,000.

Understanding the world of High-Yield Savings Accounts is the first step toward making your money work for you, not just for the bank. But there’s another powerful player in the game: the Certificate of Deposit.

What is a Certificate of Deposit (CD)?

Now, let’s talk about Certificates of Deposit, or CDs. A CD is a bit different from a savings account. Think of it like a savings account with a commitment. When you open a CD, you agree to deposit a specific amount of money and leave it there for a set period of time, which is called the “term.” This term can be as short as a few months or as long as several years. In return for your commitment, the bank offers you a fixed interest rate that is often higher than what you’d get with a HYSA.

The biggest advantage of a CD is that your interest rate is locked in for the entire term. This means that even if the Federal Reserve lowers interest rates, your CD rate stays exactly the same. You know exactly how much money you will have at the end of the term, which makes financial planning a breeze. It’s a great option for money you know you won’t need to touch for a while. Maybe you’re saving for a down payment on a house in five years, or you’re setting aside money for your child’s college tuition in ten years. A CD can be a safe and predictable way to grow that money.

The flip side of this locked-in rate and term is a lack of flexibility. If you need to access your money before the CD “matures” (that is, before the term is up), you’ll almost certainly have to pay an early withdrawal penalty. This penalty can be a flat fee or, more commonly, an amount equal to a few months’ worth of interest. In some cases, the penalty can even wipe out all the interest you’ve earned, so you need to be certain you won’t need the money before the term is over.

CDs also typically require a minimum deposit to open, which can vary from bank to bank, but is often around $500 to $1,000. Like HYSAs, CDs are FDIC-insured, providing the same level of security for your money.

Let’s do a quick recap of Certificates of Deposit:

– What it is: A savings product where you lock your money away for a specific term in exchange for a fixed interest rate.

– Flexibility: Very limited. Taking money out early results in a penalty.

– Interest Rate: Fixed for the entire term. It won’t change.

– Ideal for: Money you don’t need to access for a while, long-term savings goals.

– Safety: FDIC-insured up to $250,000.

Now that we have a clear understanding of both HYSAs and CDs, we can compare them side by side to help you make the best choice.

High-Yield Savings vs. CDs: A Head-to-Head Comparison

Choosing between a HYSA and a CD isn’t about which one is “better” in a general sense. It’s about which one is better for you and your specific financial situation. The decision comes down to a few key factors: liquidity, interest rates, and your savings timeline.

This is the biggest difference between the two. A HYSA is all about liquidity, which is a fancy word for how easily you can get to your money. If you need to pay for an unexpected car repair or a medical bill, you can transfer money out of your HYSA with no penalty. It’s your financial safety net, ready to go at a moment’s notice.

A CD, on the other hand, is the opposite of liquid. Your money is essentially in a time-out. You’ve made a deal with the bank, and breaking that deal costs you. If your savings are for something specific in the future, and you’re confident you won’t need to tap into them, a CD’s limited liquidity might not be an issue. But if there’s even a small chance you’ll need the money before the term is up, a CD is a risky choice.

The interest rate is the other major deciding factor. A HYSA’s variable rate means you get to ride the wave of the economy. If rates are rising, you’ll earn more. This can be great if you think interest rates will continue to climb. However, it also means your potential earnings are unpredictable.

A CD’s fixed rate gives you certainty. You lock in a rate today, and that’s the rate you’ll get for the next one, three, or five years. This is a huge benefit in a falling-rate environment. You could be earning 5% on your CD while new HYSA rates have dropped to 3%. This predictability is a powerful tool for planning and budgeting.

Your savings goal timeline is crucial.

Putting it all together: Making Your Choice

So, how do you decide? Let’s use a simple framework.

Choose a High-Yield Savings Account if:

– You need easy access to your money.

– You’re building an emergency fund.

– You’re saving for a short-term goal (less than two years).

– You believe interest rates might continue to rise in the near future.

– You want the flexibility to add money whenever you can.

Choose a Certificate of Deposit if:

– You have money you are 100% certain you won’t need for a set period of time.

– You’re saving for a long-term goal (more than three years).

– You want a guaranteed, predictable return.

– You want to lock in a high rate and protect yourself from future rate drops.

– You have a lump sum of money you want to invest and let grow.

It’s also important to remember that you don’t have to choose just one. Many smart savers use both. They might have a HYSA for their emergency fund and daily savings, and then a few CDs for their longer-term goals. This is a great way to get the best of both worlds—liquidity for the unexpected and fixed-rate growth for your future plans.

Conclusion: The Key is to Take Action

The world of personal finance can feel overwhelming, but making a simple choice like this can have a huge impact on your financial future. The worst thing you can do is leave your money in a traditional savings account earning next to nothing. Whether you choose a high-yield savings account or a CD, you’re making a conscious decision to get more from your money.

Start by thinking about your goals. What are you saving for? When will you need the money? Once you have those answers, the choice between a HYSA and a CD becomes much clearer. Both are safe, federally-insured ways to grow your money, but they serve different purposes. The most important step is to stop letting your money sit idle and start putting it to work for you. Happy saving!